Chase Loan Credit Score: A Comprehensive Guide To Boosting Your Financial Future

Securing a Chase loan can significantly impact your financial journey, but it all starts with understanding the crucial role of your credit score. Whether you're aiming for a mortgage, auto loan, or personal financing, your credit score plays a pivotal role in determining eligibility and interest rates. This article will delve deep into the connection between Chase loans and credit scores, providing actionable insights to help you achieve financial stability.

As one of the leading financial institutions in the United States, Chase offers a wide range of loan products tailored to meet individual and business needs. However, accessing these loans isn't as straightforward as submitting an application. Lenders like Chase rely heavily on credit scores to assess risk and determine loan approval. Understanding how credit scores influence loan decisions is the first step toward securing favorable terms.

In this guide, we'll explore the nuances of Chase loans and credit scores, offering expert advice and practical strategies to improve your financial standing. By the end of this article, you'll have a clear roadmap to enhance your creditworthiness and unlock better loan opportunities.

- Unveiling The Mystery Of 4 Girls One Fingerprint A Journey Into Identity And Unity

- Starting Your Day Right The Ultimate 094 Guide To A Perfect Morning

Table of Contents

- Chase Loan Basics: Understanding the Offerings

- Why Credit Score Matters for Chase Loans

- Breaking Down Your Credit Score

- Types of Chase Loans and Their Credit Requirements

- How to Improve Your Credit Score

- Common Mistakes to Avoid When Applying for a Chase Loan

- The Chase Loan Approval Process

- Expert Tips for Securing a Chase Loan

- Frequently Asked Questions About Chase Loan Credit Scores

- Conclusion: Taking Control of Your Financial Future

Chase Loan Basics: Understanding the Offerings

Chase Bank is renowned for its diverse loan portfolio, catering to various financial needs. From personal loans to mortgages, the institution provides tailored solutions designed to meet individual and business requirements. Understanding the different types of loans offered by Chase is essential for anyone seeking financial assistance.

Key Features of Chase Loans

Here are some of the most popular Chase loan products:

- Personal Loans: Ideal for consolidating debt or funding large purchases, Chase personal loans offer competitive interest rates and flexible repayment terms.

- Mortgage Loans: Whether you're a first-time homebuyer or refinancing an existing mortgage, Chase offers a variety of mortgage options to suit your needs.

- Auto Loans: Chase provides financing for new and used vehicles, making it easier to secure your dream car at competitive rates.

- Business Loans: For entrepreneurs and small business owners, Chase offers loans designed to support growth and expansion.

Each loan type comes with its own set of requirements, but one common factor is the emphasis on credit score. A strong credit score can significantly improve your chances of loan approval and secure better interest rates.

- Best Movies And Shows All Movie Hub 4u Has Everything You Need

- The Life And Legacy Of Ralph Bernstein An Iconic Figure In The Arts

Why Credit Score Matters for Chase Loans

Your credit score is more than just a three-digit number; it's a reflection of your financial responsibility and reliability. When applying for a Chase loan, lenders use your credit score to assess the risk of lending to you. A higher credit score indicates a lower risk, making it more likely for your application to be approved with favorable terms.

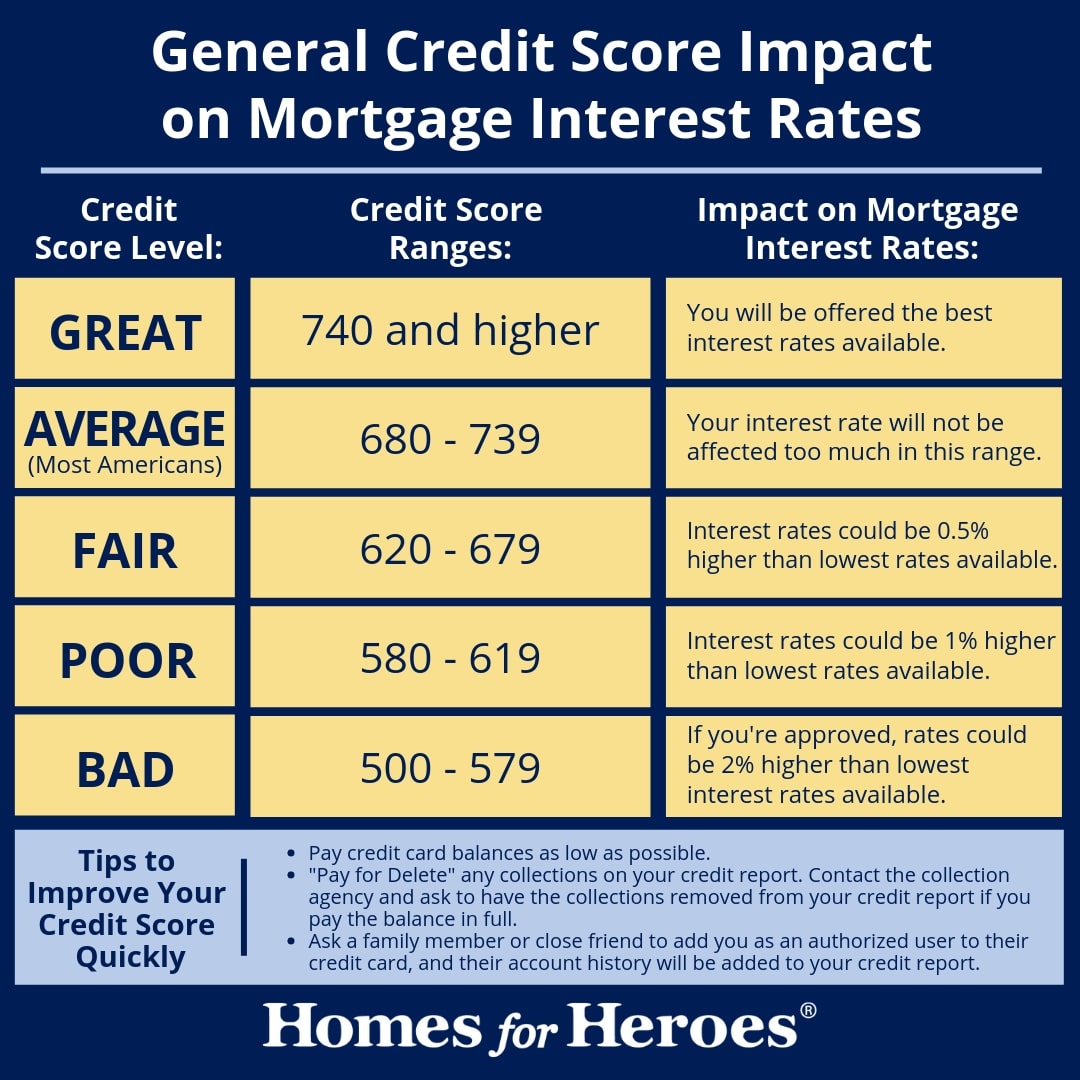

According to the FICO Score, the most widely used credit scoring model, a score above 670 is generally considered good, while scores above 740 are deemed excellent. Chase often requires borrowers to have a credit score within these ranges to qualify for the best loan options.

How Credit Scores Impact Loan Terms

Here's how your credit score can affect your Chase loan application:

- Interest Rates: Borrowers with higher credit scores are typically offered lower interest rates, reducing the overall cost of borrowing.

- Loan Approval: A strong credit score increases the likelihood of loan approval, providing greater access to financial resources.

- Loan Limits: Higher credit scores often result in higher loan limits, allowing you to borrow more when needed.

Breaking Down Your Credit Score

Understanding the components of your credit score is crucial for improving it. Credit scores are calculated based on several factors, each carrying a different weight in the scoring model.

Key Factors Influencing Your Credit Score

- Payment History (35%): Consistently paying bills on time has the most significant impact on your credit score.

- Credit Utilization (30%): Keeping your credit card balances low relative to your available credit limits can improve your score.

- Length of Credit History (15%): A longer credit history demonstrates financial stability and responsibility.

- Credit Mix (10%): Having a diverse range of credit accounts, such as credit cards, mortgages, and auto loans, can positively affect your score.

- New Credit (10%): Limiting the number of new credit applications can prevent a drop in your score.

By addressing these factors, you can take proactive steps to enhance your creditworthiness and increase your chances of securing a Chase loan.

Types of Chase Loans and Their Credit Requirements

Chase offers a variety of loan products, each with specific credit score requirements. Understanding these requirements can help you determine which loan option is right for you.

Personal Loans

For personal loans, Chase typically requires a credit score of at least 660. However, borrowers with scores above 700 may qualify for lower interest rates and more favorable terms.

Mortgage Loans

Chase mortgage loans often require a minimum credit score of 620. Conventional mortgages may have higher requirements, while FHA loans may accept lower scores with additional documentation.

Auto Loans

Chase auto loans generally require a credit score of at least 680 for new vehicles and 660 for used vehicles. Borrowers with higher scores can expect better financing options.

Business Loans

For business loans, Chase considers both personal and business credit scores. A personal credit score of at least 680 is often required, along with a strong business credit profile.

How to Improve Your Credit Score

Improving your credit score takes time and effort, but the results can significantly enhance your financial opportunities. Here are some practical strategies to boost your credit score:

Pay Bills on Time

Consistently paying your bills on time is the most effective way to improve your credit score. Set up automatic payments or reminders to ensure timely payments.

Reduce Credit Card Balances

Lowering your credit card balances can improve your credit utilization ratio, positively impacting your score. Aim to keep balances below 30% of your available credit limit.

Limit New Credit Applications

Each new credit application can temporarily lower your credit score. Avoid applying for multiple credit accounts within a short period to maintain a stable score.

Monitor Your Credit Report

Regularly checking your credit report allows you to identify and dispute errors that may negatively affect your score. Use free resources like AnnualCreditReport.com to access your report annually.

Common Mistakes to Avoid When Applying for a Chase Loan

Making common mistakes during the loan application process can harm your chances of approval. Here are some pitfalls to avoid:

- Ignoring Credit Score Requirements: Ensure your credit score meets Chase's minimum requirements before applying.

- Overlooking Documentation: Provide all necessary documentation to support your application, including proof of income and employment.

- Applying for Multiple Loans Simultaneously: Submitting multiple loan applications can trigger multiple hard inquiries, negatively affecting your credit score.

- Not Reviewing Loan Terms: Carefully review the terms and conditions of the loan to avoid unexpected fees or unfavorable terms.

The Chase Loan Approval Process

Understanding the loan approval process can help you prepare for a successful application. Here's an overview of what to expect:

Step 1: Application Submission

Begin by completing the Chase loan application, providing all necessary information and documentation.

Step 2: Credit Evaluation

Chase will evaluate your credit score and history to assess your eligibility and determine loan terms.

Step 3: Underwriting

An underwriter will review your application, verifying information and ensuring compliance with lending standards.

Step 4: Loan Approval

If approved, you'll receive a loan offer outlining the terms and conditions. Review the offer carefully before accepting.

Expert Tips for Securing a Chase Loan

Here are some expert tips to increase your chances of securing a Chase loan:

- Build a Strong Credit History: Focus on improving your credit score by paying bills on time and reducing debt.

- Provide Comprehensive Documentation: Ensure all required documents are accurate and up-to-date.

- Consider Co-Signers: If your credit score is borderline, consider adding a co-signer with a strong credit history.

- Engage with Chase Financial Advisors: Seek guidance from Chase financial advisors to optimize your application.

Frequently Asked Questions About Chase Loan Credit Scores

Q: What is the minimum credit score required for a Chase loan?

A: The minimum credit score requirements vary depending on the loan type. Generally, Chase requires a credit score of at least 620 for mortgage loans, 660 for personal loans, and 680 for business loans.

Q: Can I improve my credit score quickly?

A: While significant improvements take time, you can make modest gains by paying down balances, disputing errors, and avoiding new credit applications.

Q: Does Chase offer loans to individuals with poor credit?

A: Chase primarily focuses on borrowers with good to excellent credit scores. However, alternative lenders may offer options for individuals with poor credit.

Conclusion: Taking Control of Your Financial Future

Securing a Chase loan with a strong credit score can open doors to new financial opportunities. By understanding the importance of credit scores and taking proactive steps to improve them, you can enhance your chances of loan approval and secure favorable terms. Remember to avoid common mistakes, engage with financial advisors, and monitor your credit report regularly.

We encourage you to take action today by reviewing your credit score and preparing your application. Share your thoughts and experiences in the comments below, and don't forget to explore other informative articles on our website. Together, let's build a brighter financial future!

Article Recommendations

- Starting Your Day Right The Ultimate 094 Guide To A Perfect Morning

- Hd4hub Movies Latest Releases Best Action Films To Watch Right Now

Detail Author:

- Name : Brennon Gaylord

- Username : shields.jade

- Email : mitchell98@wilderman.net

- Birthdate : 1988-07-12

- Address : 45625 Kuphal Roads North Lyricchester, SC 57882-8334

- Phone : 1-281-382-3109

- Company : Wilderman-Klein

- Job : Actor

- Bio : Quia qui sit nam fugiat sed ipsum perferendis. Debitis maiores enim officiis ea aut.

Socials

facebook:

- url : https://facebook.com/karley8161

- username : karley8161

- bio : Est aut necessitatibus dolor nobis reiciendis et.

- followers : 5132

- following : 1950

instagram:

- url : https://instagram.com/karley9314

- username : karley9314

- bio : Facilis saepe error quis rerum. Dolorum est nihil ipsam nam. Vitae cumque dicta qui aperiam.

- followers : 2944

- following : 2802